On January 29, 1845, the New York Evening Mirror published a poem that would go on to be one of the most celebrated narrative poems ever penned.

It depicted a tragic romantic's desperate descent into madness over the loss of his love; and it made its author, Edgar Allan Poe, one of the most feted poets of his time.

The poem was entitled "The Raven," and its star was an ominous black bird that visits an unnamed narrator who is lamenting the loss of his true love, Lenore. (We'll get back to Bart Simpson dressed as the Raven later on.)

Today, the sad tale would be splashed on the cover of a million tabloid magazines with a title such as "Lenore Dumps Narrator," "I'll Never Find True Love Again — Narrator Spills on Tragic Split With Lenore," or even "Kanye & Lenore — It's Love! But Don't Tell The Narrator." But 1845 was the very epitome of "old school," and so the poor, bereft narrator's tale was shared with the world through a complex rhyme and metering scheme that was popularized by Elizabeth Barrett Browning in her poem "Lady Geraldine's Courtship."

"POETRY NERD!"

Quiet at the back or I'll have you removed.

Now, as the narrator slips slowly, desperately into the pit of insanity, he discovers that the raven, with the license afforded the poet, can talk; and so he sets about asking the mysterious bird for guidance in navigating his torment:

Then this ebony bird beguiling my sad fancy into smiling,

By the grave and stern decorum of the countenance it wore,

"Though thy head be shorn and shaven, thou," I said, "art sure no craven,

Ghastly grim and ancient Raven wandering from the Nightly shore —

Tell me what thy lordly name is on the Night's Plutonian shore!"

Quoth the Raven "Nevermore."

Unfortunately for the narrator, the raven's vocabulary is limited to the single word nevermore, which, in a rare moment of clarity, the narrator reasons can only have been learned from an unhappy former owner:

Startled at the still! ness broken by reply so aptly spoken,

"Doubtless," said I, "what it utters is its only stock and store

Caught from some unhappy master whom unmerciful Disaster

Followed fast and followed faster till his songs one burden bore —

Till the dirges of his Hope that melancholy burden bore

Of 'Never — nevermore'."

It's at this point that the narrator demonstrates beyond any last vestige of remaining doubt that he is, in fact, completely insane when, knowing full well that there is only one possible answer to any question he might pose his strange visitor, he pulls up a "cushioned seat" in front of the bird and proceeds to question him:

But the Raven still beguiling my sad fancy into smiling,

Straight I wheeled a cushioned seat in front of bird, and bust and door;

Then, upon the velvet sinking, I betook myself to linking

Fancy unto fancy, thinking what this ominous bird of yore —

What this grim, ungainly, ghastly, gaunt, and ominous bird of yore

Meant in croaking "Nevermore."

So, with the vision firmly planted in your mind's eye of a man completely out of touch with reality, seeking wisdom from a mysterious talking bird — knowing that there is only one response, no matter the question — Dear Reader, allow me to present to you a chart.

It is one I have used before, but its importance is enormous, and it will form the foundation of this week's discussion (alongside a few others that break it down into its constituent parts).

Ladies and gentlemen, I give you (drumroll please) total outstanding credit versus GDP in the United States from 1929 to 2012:

[ Enlarge Image ]

[ Enlarge Image ]

Source: St. Louis Fed

This one chart shows exactly WHY we are where we are, folks.

From the moment Richard Nixon toppled the US dollar from its golden foundation and ushered in the era of pure fiat money (oxymoron though th! at may be! ) on August 15, 1971, there has been a ubiquitous and dangerous synonym for "growth": credit.

The world embarked upon a multi-decade credit-fueled binge and claimed the results as growth.

Fanciful.

Floated ever higher on a cushion of credit that has expanded exponentially, as you can see. (The expansion of true growth would have been largely linear — though one can only speculate as to the trajectory of that GDP line had so much credit NOT been extended.) The world has congratulated itself on its "outperformance," when the truth is that bills have been run up relentlessly, with only the occasional hiccup along the way (each of which has manifested itself as a violent reaction to the over-extension of cheap money.

Along the way, the cost of that cheap money has drifted consistently lower from its peak in 1980 — and the falloff was needed in order that we be able to keep squeezing juice from an increasingly manky-looking lemon:

[ Enlarge Image ]

[ Enlarge Image ]

Source: Bloomberg

But the Fed has decided that when life gives you lemons, you make Lemon-aid.

Of course, the problem comes when you reach the point where you are no longer charging for that "cheap" money but rather giving it away — or in the case of the interest paid on excess reserves held at the Fed, paying people to take it.

Excess reserves held on deposit at the Federal Reserve currently total $2.4 trillion, which at an a rate of 0.25% per annum equates to $6,000,000,000 (that's $6 billion to you and me) in interest payable to US banks.

[ Enlarge Image ]

[ Enlarge Image ]

Source: St Louis Fed

Remember when that used to be real money? Seems such a long time ago, doesn't it? Now it doesn't even cover the fines payable for market manipulation. In actual fact, it's almost twice the amount req! uired jus! t 15 years ago in order to save LTCM and stop the global financial system from melting down.

Deflation? Not in the cost of bailouts there isn't.

Naturally, when you have no more room to juice one side of the equation, the other side suffers accordingly; and though it may not have happened yet, and though the geniuses in charge of coming up with the next great delaying tactic are still in the game, the end isn't very far away.

This issue of debt is one that just won't go away — and it isn't just a modern phenomenon, of course. In fact, as David Graeber pointed out in his wonderfully titled book Debt: The First 5,000 Years, debt formed the very foundations of one of the world's first and, to this day, most august central banking institutions: the Bank of England:

In fact this is precisely the logic on which the Bank of England — the first successful modern central bank — was originally founded. In 1694, a consortium of English bankers made a loan of £1,200,000 to the king. In return they received a royal monopoly on the issuance of banknotes. What this meant in practice was they had the right to advance IOUs for a portion of the money the king now owed them to any inhabitant of the kingdom willing to borrow from them, or willing to deposit their own money in the bank — in effect, to circulate or "monetize" the newly created royal debt.

This was a great deal for the bankers (they got to charge the king 8 percent annual interest for the original loan and simultaneously charge interest on the same money to the clients who borrowed it), but it only worked as long as the original loan remained outstanding. To this day, this loan has never been paid back. It cannot be. If it ever were, the entire monetary system of Great Britain would cease to exist.

You see? THAT'S the problem. Right there.

The debt that underpins the banking systems of the world can never be paid back. Period. If it were, everything would collapse.

Just this week, a buddy of mine in Hon! g Kong wh! o watches everything (and I mean everything) like a hawk sent me an email about some of the finer points of the latest Fed quarterly report, which was released this week.

In particular, he wanted to point out something that isn't exactly new news but that is perhaps forgotten amidst the general hue and cry over QE: the solidity of the Fed's balance sheet.

The quarterly report contains a wealth of useful information. For instance, the maturity distribution of all those treasuries that the Fed has been so graciously accumulating, to the tune of $45 billion a month:

| Maturity Distribution of Treasury Securities |

| 10 Years | $535 billion |

| Avg. Weighted Life | 5.9 years |

| Source: Federal Reserve |

Or the MBS they've been splashing out $40 billion a month on:

| Maturity Distribution for GSE MBS |

| 5-10 Years | $2.6 billion |

| >10 Years | $1,340 billion |

| Avg. Weighted Life | 3.3 years |

| Source: Federal Reserve |

But the best little nugget in this whole 32-page report is the table that displays the assets, liabilities, and capital of the Federal Reserve System:

[ Enlarge Image ]

[ Enlarge Image ]

Source: Federal Reserve

Yes, the Fed has $55 billion of total capital and assets of $3.843 trillion, which means that the Federal Reserve is leveraged roughly 70x.

Remember that whole GFC thing a few years ago? No? Well, let me refresh your memory:

(Wikipedia): The financial crisis of 2007—2008, also known as the Global Financial Crisis and 2008 financial crisis, is considered by many economists the worst financial crisis since the Great Depression of the 1930s. It resulted in the threat of total collapse of large financial institution! s, the ba! ilout of banks by national governments, and downturns in stock markets around the world. In many areas, the housing market also suffered, resulting in evictions, foreclosures and prolonged unemployment. The crisis played a significant role in the failure of key businesses, declines in consumer wealth estimated in trillions of U.S. dollars, and a downturn in economic activity leading to the 2008-2012 global recession and contributing to the European sovereign-debt crisis.

Ohhhhh... THAT GFC thing. It all seems soooooo 2008, doesn't it?

Anyway, Wikipedia goes on:

(Wikipedia): The U.S. Financial Crisis Inquiry Commission reported its findings in January 2011. It concluded that "the crisis was avoidable and was caused by: widespread failures in financial regulation, including the Federal Reserve's failure to stem the tide of toxic mortgages; dramatic breakdowns in corporate governance including too many financial firms acting recklessly and taking on too much risk; an explosive mix of excessive borrowing and risk by households and Wall Street that put the financial system on a collision course with crisis; key policy makers ill prepared for the crisis, lacking a full understanding of the financial system they oversaw; and systemic breaches in accountability and ethics at all levels."

(Emphasis well and truly mine)

Those financial firms "acting recklessly and taking on too much risk" looked something like this:

[ Enlarge Image ]

[ Enlarge Image ]

Sources: Wikipedia, company reports

What's that blue bar? Oh, the one on the right? Oh... well, that's the leverage of the Federal Reserve today. Isn't it amazing the latitude that is available when you can conjure money out of thin air?

But it wasn't just the banks that caused all the problems, according to the US Financial Crisis Commission. An "explosive mix of excessive borrowing and risk by households" was also to blame! .

S! o, with everything seemingly hunky-dory now, that excessive borrowing must have been sorted out, no?

Not so fast.

The UK has recently seen the coalition government trumpeting what they call a "recovery," except that, once again, a lot of the newfound "strength" in the once-moribund UK economy can be attributed — you guessed it — to our old friend household debt:

(BBC): Household debt in the UK has reached a record level, according to figures from the Bank of England.

Individuals now owe a total of £1.43 trillion, including mortgage debt, slightly above the previous high.

The previous record was set in September 2008, just before the effects of the financial crisis and the recession began to bite.

Record household debt levels? Will we never learn?

Of course, the government had a handy way of looking at this development that made it all seem like... what's the phrase I'm looking for...?

Ah yes... thanks Jamie... a "tempest in a teapot":

(BBC): But the government said that relative to household income, debt had actually fallen.

The rise may reflect the willingness of consumers to borrow more, as a recovery comes into sight.

Sheesh...

Reality check, please, BBC:

(BBC): However, the figures may also show that families are having to borrow to deal with the higher cost of living, and to pay household bills.

The precise amount of total household debt is £1,429,624,000,000. That compares with the previous high of £1,429,595,000,000 five years ago, a difference of just £29m.

On average, that means each adult in the UK owes £28,489, including any home loans....

The news of the record debt level may increase concerns that the UK's recovery is based on increased borrowing, rather than growth sustained by rising incomes.

Hmmm... but the trouble is that it's not just the UK which is going debt-crazy again. Elsewhere we see similar issues manifesting themselves. And it's happening in places you maybe wouldn't ! think of.! Like Malaysia and Thailand, for example:

(The Star): Malaysia's rising household debts, while still manageable in this current economic condition, would be "problematic" if the country's growth rate slows, according to Standard & Poor's.

A study by the World Bank identified Malaysia and Thailand as having the largest household debts, as a share of gross domestic product (GDP), among Asia's developing economies.

Household debts in Malaysia have now exceeded 80% of GDP, prompting the government to introduce measures to curb credit growth.

S&P last month cut its credit outlook for four Malaysian banks on concerns that rising home prices and household debt are contributing to economic imbalances.

"Thailand and Malaysia economies are fine at this point in time," S&P financial rating services' managing director and lead analytical manager Ritesh Maheshwari said yesterday.

"But an unfavourable global economic event could affect Malaysia adversely, and this is why we have been highlighting in our reports that Thailand and Malaysia face risks," he said in a teleconference on Asia-Pacific's outlook for 2014.

And Canada:

[ Enlarge Image ]

[ Enlarge Image ]

Source: Bloomberg

(CTV News): Canadians' debt-to-income ratio has soared to 163 per cent, much higher than previously believed, according to revised Statistics Canada figures.

The household debt level has increased 1.8 per cent in the second quarter, bringing it to a similar level seen in the United States before the housing bust and the 2008 financial crisis.

Statistics Canada said the new figures are the result of a revised method used to measure household net worth, which is more in line with international accounting standards. Non-profit institutions have been removed from the household category to get a better representation of family finances.

While the latest figures are troubling, RBC Chi! ef Econom! ist Craig Wright says they shouldn't necessarily trigger alarm bells.

The Canadian household debt "doesn't strictly compare with the U.S.," he told CTV's Power Play Monday.

About 70 per cent of household credit is mortgage-related, Wright said, but new data suggests housing markets across Canada, except in Vancouver, are cooling off.

The Canadian Real Estate Association said Monday that sales of existing homes fell 15.1 per cent in September from a year ago, although last month's numbers were slightly higher than in August.

"So as we move forward we hope (the debt) ratio will stabilize," Wright said.

Let's "hope" he's right.

How about those bastions of financial probity, the Swedes?

(The Local): In an interview with the Bloomberg news agency, Martin Andersson, the head of Sweden's Financial Supervisory Authority (Finansinspektionen), expressed his concern about Swedes' mounting debts.

"Swedish households today are among the most indebted in Europe, and we cannot have household lending that spirals out of control," Andersson said....

Last year, Swedes' household debt hit a record 173 percent of disposable income, well above the 135 percent level during the height of Sweden's banking crisis in the early 1990s.

According to Sweden's National Housing Board (Boverket), Sweden is already in the midst of a housing bubble, with homes overvalued by around 20 percent.

As property prices have risen 25 percent since 2006, Andersson warned of a possible "downturn" in the Swedish housing market.

"House prices cannot just continue upwards in eternity," he told Bloomberg.

Iceland?

(WSJ): Iceland's government unveiled a 150 billion Icelandic kronur ($1.25 billion) household-debt relief program Saturday, with the plan calling for increased taxes on the financial-services industry to help fund mortgage write-downs for Icelanders equivalent to several thousand dollars per mortgage holder.

The program, unveiled by Prime Minister Sigmun! dur Daví! ð Gunnlaugsson about six months after taking office, comes after a 2013 election where promises to address high levels of household debt in the small island nation was a central issue. While the economy has rebounded following a financial meltdown five years ago, people still struggle to pay mortgages.

I could go on... in fact I will.

Korea:

(The Star): The debt burden carried by South Korean households edged up this year as debts grew at a brisker pace than incomes, a survey said on Tuesday, putting pressure on policy-makers aiming to maintain a steady recovery in Asia's fourth-largest economy.

Total debt at South Korean households grew by an average 6.8% to 58.18 million won (US$55,000) as of March this year, of which 39.67 million won was in the form of financial debt, the survey by the central bank and two top local authorities found.

In comparison, annual disposable income rose by 4.9% in 2012, resulting in the ratio of financial debt to disposable income rising to 108.8% in this year's survey, from 106% in 2012.

"Pressure on households has grown as South Koreans have increased their debt in comparison to the assets they carry, resulting in worse financial soundness," said an official at the Bank of Korea.

Russia:

(FT): Russia's central bank has warned that Russia's consumer lending sector threatens the country's "financial stability", the same day that it revoked the licence of Master Bank, a midsized retail lender.

Addressing the Russian Duma, central bank head Elvira Nabiullina reiterated the need for setting a maximum interest rate level for consumer loans due to growing concerns of a bubble in the sector.

"There are already visible elements of overheating," Ms Nabiullina said, noting the "exceptionally high level" of households' indebtedness, especially compared with real growth in wages. "Consumer loans may not be so much the engine of growth as a threat to financial stability."

In the first nine months of the year, consumer l! ending ro! se 36 per cent, with non-performing loans now totalling 7.7 per cent, versus 5.9 per cent at the start of the year. The number of people with four consumer loans or more has close to doubled, signalling a deterioration in banks' credit portfolios.

You take my point?

I don't like to flog a dead horse, but it's high time people took the time and the trouble to really understand what's going on here; and it's ALL about debt.

Meanwhile, in the USA, the "recovery" seems to have miraculously coincided with — guess what — a slowing in the deleveraging cycle that began so dramatically in 2008:

(Quartz): During the third quarter of 2013, total US consumer debt outstanding rose $127 billion, to a total of $11.28 trillion. That's the largest quarter-on-quarter increase since the first quarter of 2008, when the financial crisis was nothing but a glimmer in the eye of the financial markets.

[ Enlarge Image ]

[ Enlarge Image ]

Source: Quartz/FRB NY

Basically, this just shows that the mortgage market was really starting to get to work during the third quarter. Mortgage debt rose by $56 billion during the quarter. Some of that might have had to do with a rush from people to lock in low mortgage rates, amid signs that the Fed might scale back monetary easing that has pushed rates down. Student debt also continued its long-term march higher, increasing by $33 billion during the quarter. Auto loans — crucial to another part of the American economy — rose by $31 billion. Here's a look at the non-mortgage debt growth.

[ Enlarge Image ]

[ Enlarge Image ]

Wasn't it debt that got us into the problems the US economy has faced in recent years? Well, yes. Too much debt — especially home loans made by the banks to people with little reasonable chance of paying them off — was ! central t! o causing the crisis.

But at the same time, restarting demand for borrowing remains the key to restarting economic growth. The hard fact is that capitalism runs on debt. It's the fuel that makes the whole system work. If you don't like it, you're more than welcome to go search for another hegemonic economic paradigm to live under. Good luck.

Good luck indeed.

This fixation with debt is fine BUT, if you want to live in a society where everybody borrows from everybody else and we all get fat, rich, and happy, there ARE a couple of trade-offs that you have to sign up for.

The first trade-off is that there WILL be periodic points in time when the debt load gets too heavy and people get nervous. Companies will go bankrupt, people will too — it's the natural order of things.

The second is that, when those moments arrive, it is wholly unfair to punish those who decided not to climb aboard the Debt Express and chose instead to save assiduously.

The Austrian economist Joseph Schumpeter called this part of the cycle "creative destruction" — although he took his inspiration from a somewhat unusual source:

Modern bourgeois society, with its relations of production, of exchange and of property, a society that has conjured up such gigantic means of production and of exchange, is like the sorcerer who is no longer able to control the powers of the nether world whom he has called up by his spells....

It is enough to mention the commercial crises that by their periodical return put the existence of the whole of bourgeois society on trial, each time more threateningly. In these crises, a great part not only of existing production, but also of previously created productive forces, are periodically destroyed. In these crises, there breaks out an epidemic that, in all earlier epochs, would have seemed an absurdity — the epidemic of over-production.

Society suddenly finds itself put back into a state of momentary barbarism; it appears as if a famine, a universal war! of devas! tation, had cut off the supply of every means of subsistence; industry and commerce seem to be destroyed; and why? Because there is too much civilisation, too much means of subsistence, too much industry, too much commerce.

The productive forces at the disposal of society no longer tend to further the development of the conditions of bourgeois property; on the contrary, they have become too powerful for these conditions.... And how does the bourgeoisie get over these crises? On the one hand by enforced destruction of a mass of productive forces; on the other, by the conquest of new markets, and by the more thorough exploitation of the old ones. That is to say, by paving the way for more extensive and more destructive crises, and by diminishing the means whereby crises are prevented.

Those are the words of none other than Karl Marx, and THESE:

Politics is the art of looking for trouble, finding it everywhere, diagnosing it incorrectly, and applying the wrong remedies.

... are the words of Groucho Marx.

Each had a point.

Now, as far as the first trade-off goes, we have found a magical way to get around that part of the natural order: it's called "printing money."

And the second? Well, unfortunately those doomed savers are the only ones who actually HAVE any real money with which to plug the holes; so, at the risk of getting a little quote-happy, we must resort to the logic of everybody's favourite Vulcan:

"The needs of the many outweigh the needs of the few."

Sorry, Spock, that may fly on Vulcan but not down here on Earth.

If you want to live high on the hog, you have to accept that when the bills come due, they must be paid. In 2008 those bills came due, but the payment of them would have caused so much creative destruction that the politicians (and central bankers) felt compelled to step in. They found the trouble, diagnosed it incorrectly, and then applied the wrong remedies.

2008 was two things:

1) The result of far too much debt

2) ! The nearest thing to a truly global financial calamity the world has ever seen.

However, since 2008 the debt level has been increased massively and shifted to the public balance sheet in order to fix the problem. Now, with "recoveries" being hailed left and right, households are once again taking on new debt, which is seen as a sign of confidence.

Has the old debt been expunged? No. Have governments taken on debts which they intend to pay down as soon as the ship is righted? Of course not.

Take another look at this chart:

[ Enlarge Image ]

[ Enlarge Image ]

Source: St. Louis Fed

See that tiny downdraft I've circled?

That was what ALLLL the fuss was about, and THAT tiny reduction in credit — aka "The Great Deleveraging" — was what caused all the pain.

Think this is going to get voluntarily fixed in the way nature dictates any time soon?

Of course it isn't. It can't be.

Everything we get, outside of the free gifts of nature, must in some way be paid for. The world is full of so-called economists who in turn are full of schemes for getting something for nothing. They tell us that the government can spend and spend without taxing at all; that it can continue to pile up debt without ever paying it off, because "we owe it to ourselves."

— Henry Hazlitt, Economics in One Lesson: The Shortest & Surest Way to Understand Basic Economics

What part of this does anybody have a hard time understanding?

And now we come to Christmas — when balance sheets are forgotten and the splurge that every Western consumer knows is his birthright takes place regardless of personal financial probity.

Nowhere is this tendency more entrenched than the United Kingdom, as a recent article in The Guardianpointed out:

(UK Guardian): There have been credible predictions of a 3.5% rise in 2013, and yuletide spending exceeding £40bn. Certainly, the season! al noise ! suggests pathological consumerism is back in full effect, with near riots on so-called Black Friday, internet shopping breaking records, and adverts — adverts! — being treated as news events. "Britain's Christmas spending binge leaves US trailing" was a headline last week on Bloomberg, which surely spoke volumes.

In some parts of the country, then, the giddiness sown by a hyped-up recovery and rising house prices — up by an annual average of 7.7%, according to Halifax, with George Osborne's Help To Buy scheme having played its part — is evidently doing its work.

Meanwhile, the grim state of far too much of the economy is unchanged: 21% of employees are paid less than the living wage, and part-time and temporary jobs run rampant. The weekend brought news that, for the first time, more than half the 13 million Britons classified as being poor live in working households: a real watershed that needs to be endlessly highlighted. Even for people higher up the income scale, life remains pinched and anxious: petrol bought journey by journey; bills deferred; dread when a replacement car has to be bought. The fact that the ongoing fall in real wages has become a political cliche does not make it any less real: between 2010 and 2012, real earnings fell in every part of the UK — by 7.5% in London, and a mind-boggling 8.1% in Yorkshire and the Humber.

So, what pays for the sticky chicken lollipops and iPads? People are raiding their savings, which have lately undergone their biggest drop in 40 years, enough to prompt a former Downing Street adviser to warn that such figures are "desperately worrying… If you just withdraw money and spend you are talking about a recipe for long-term economic decline."

Desperately worrying, indeed — but without this dynamic, George Osborne's "recovery" is dead in the water.

Looking into the composition of the debt in the UK becomes more and more frightening the deeper you go:

(UK Guardian): And then there is debt. The Office for Budget ! Responsib! ility says the ratio of household debt to income is set to start increasing again, and at a faster rate than it predicted in March. By 2015, household debt, including mortgages, is projected to exceed £2tn. the critical point is how it is distributed. Last week, the Resolution Foundation's ever-insightful Gavin Kelly had a piece in the Financial Times warning that a sixth of private debt is held by households that have less than £200 a month to cover anything more than basic essentials. Nearly a third of mortgage debt, he pointed out, is owed by people who have borrowed more than four times their annual income.

Ruh-roh!

The author then hammers home his point about the great British consumer, but he nets a far broader cross-section than he perhaps intended:

(UK Guardian): And a watershed moment will be reached when interest rates start to go up again.

Ahhhhh... yes. That.

Folks, rates WILL have to go up again. They cannot stay at zero forever. We all know that. When they DO, because of all the additional debt that has been ladled atop the existing pile, the whole thing will come tumbling down.

All of it.

There is simply no way out, I am afraid. But that is clearly a problem for another day. Right now, everything is fine, so we can all go on pretending it will continue that way.

Evermore.

So all that remains is for me to answer the one question I KNOW has been on your mind: why did this week'sThings That Make You Go Hmmm... open with a picture of Bart Simpson dressed as the raven?

The very first Simpsons "Treehouse of Horror" episode, in 1990, contained a parody of The Raven in which Homer played the poor mad narrator and Bart the brooding bird.

It was good enough for The Simpsons, so I figured I'd take my own stab at updating Poe's epic poem. So now, if you'll indulge me in a little poetic license (not to mention there being not one but four mysterious strangers in my offering), I give you, "The Maven" (abridged version):

Once upon! a midnig! ht dreary, while I pondered, weak and weary,

Over many a quaint and curious volume of financial lore

While I nodded, nearly napping, suddenly there came a tapping,

As of some one gently rapping, rapping at my chamber door.

"'Tis some visiter," I muttered, "tapping at my chamber door

Only this and nothing more."

space

Ah, distinctly I remember it was in the bleak December;

And each separate dying ember wrought its ghost upon the floor.

Eagerly I wished the morrow; — for the world had sought to borrow

From both friend and foe and neighbour — borrow, borrow, borrow more

For the cheap and easy money which the bankers forth did pour

Shall be paid back nevermore.

space

Deep into that darkness peering, long I stood there wondering, fearing,

Doubting, dreaming dreams no mortal ever dared to dream before;

But the silence was unbroken, and the stillness gave no token,

And the only word there spoken was the whispered words, "Some More?"

This I whispered, and an echo murmured back the words, "Some More"

Merely this and nothing more.

space

Open here I flung the shutter, when, with many a flirt and flutter,

In there stepped four stately Mavens from the Central Banks of yore;

Not the least obeisance made they; not a minute stopped or stayed they;

But, with air of lord or lady, stood inside my chamber door —

Standing by a mug from Dallas just inside my chamber door —

Stood, and stared, and nothing more.

space

Then these tired-looking men beguiling my sad fancy into smiling,

By the grave and stern decorum of the countenance they wore,

"Though thy faces look unshaven, thou," I said, "art sure enslaven'd,

Ghastly grim and ancient Mavens wandering from the Nightly shore —

To free money ever af! ter lest ! the markets pitch and yaw."

Quoth the Mavens, "Evermore."

While I marvelled this ungainly bearded man explained so plainly,

Though his answer little meaning — little relevancy bore;

For he cannot help a-printing, brand new currency a-minting

Ever yet was blessed with seeing nothing wrong in doing more

Mortgage bonds upon his balance sheet he'll place, then markets jaw

With the promise "Evermore."

space

Startled at the stillness broken by reply so aptly spoken,

"Doubtless," said I, "what's it matter? Long as stocks they have a floor

Rising sharply, rising faster, never chance of some disaster

Until finally, at last the bubble bursts amidst a roar

Till the dirges of his Hope that melancholy burden bore

Of 'Ever — evermore.' "

space

But the Maven, still eyes glinting, more fresh money kept on printing,

Straight I wheeled a cushioned seat in front of Ben, and locked the door;

Then, upon the velvet thinking, I betook myself to linking

Money unto money, thinking what this ominous man of more

What this grim, ungainly, ghastly, gaunt, and ominous man of more

Meant in croaking "Evermore."

Then, methought, the air grew denser, perfumed from an unseen censer

Swung by Mario whose foot-falls tinkled on the tufted floor.

"Wretch," I cried, "thy words have spared thee — troubled markets haven't dared thee

Though the Bundesbank declared thee cannot simply conjure more;

Stop, oh stop this printing money and accept the final score!"

Quoth the Maven, "Evermore."

space

"Profit!" said I, "on your buying? You'll be broken, battered, crying

Whether markets pause, or whether markets climb a little more,

Rising fear amongst the masses, each and every player has his

Line which crossing will restore his sense of what has gone before

Will he — will they just rely on that of which you seemed so sure?

Quoth the Maven, "Ever! more."

"You there" said I, "standing muted — what is there to do aboot it?"

In a heavy accent quoth he — that by God he was quite sure

That more money being printed and, new measures being hinted

At would quell all fear of meltdown and the markets all would soar

Would this mean the printing presses would forever roar?

Quoth the Maven, "Evermore."

space

Lastly to the fore there strode a small and bookish man,

Kuroda,

Who with glint of eye did warn that he was happy to explore

Measures once thought so outrageous as to never mark the pages

In the history of finance — but those times were days of yore

Drastic printing was required, this was tantamount to war

Quoth the Maven, "Evermore."

space

And the Mavens, never blinking, only sitting, only thinking

By the Cowboys mug from Dallas just inside my chamber door;

Really do believe their action has created decent traction,

And that freshly printed money can spew forth for evermore;

But the truth about the ending shall be seen when markets, bending

Shall be lifted — nevermore!

(My thanks to the wonderfully named "Virtues," who for a small fee drew the Simpsons characters for me. Should you wish to have your own then contact her HERE. Her work is excellent, and she turned these around in 24 hours for me!)

*******

OK ... so let's get to it, shall we?

This week we hear how Samsung is protecting its margins and why that's not good news for China; Jim Chanos is bearish (yeah, no sin of HIM throwing in the towel); Japan's GPIF — the largest pension fund in the world — faces up to a stark reality; and the good folks at SWIFT may have jumped the gun with a landmark announcement.

The Eurozone nightmare is back, and Liam Halligan explains what that means; the world's largest investor sounds the alarm (surely people will listen to THEM?); China's coal industry reaches a crossroads; and Vladimir Putin's recent speech ! suggests ! trouble in Mother Russia.

A trillion dollars goes missing from developing countries; Indians drive gold prices up to unprecedented premiums; and we look at the complete history of Bitcoin.

David Stockman, the 1%ers, and even a Bloomberg reporter who seems to get the joke on gold ('tis the season, I guess) round things out for another week.

All that remains is for me to wish all of you a Merry Christmas and a happy, healthy, and prosperous 2014. Thanks for your company this year. It's been a hell of a ride.

About the author:http://valueinvestorcanada.blogspot.com/

| Currently 4.00/512345 Rating: 4.0/5 (1 vote) |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

SPY STOCK PRICE CHART

179.22 (1y: +23%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'SPY', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1355810400000,145.37],[1355896800000,144.29],[1355983200000,145.12],[1356069600000,142.79],[1356328800000,142.35],[1356501600000,141.75],[1356588000000,141.56],[1356674400000,140.03],[1356933600000,142.41],[1357106400000,146.06],[1357192800000,145.73],[1357279200000,146.37],[1357538400000,145.97],[1357624800000,145.55],[1357711200000,145.92],[1357797600000,147.08],[1357884000000,147.07],[1358143200000,146.97],[1358229600000,147.07],[1358316000000,147.05],[1358402400000,148],[1358488800000,148.33],[1358834400000,149.13],[1358920800000,149.37],[1359007200000,149.41],[1359093600000,150.25],[1359352800000,150.07],[1359439200000,150.66],[1359525600000,150.07],[1359612000000,149.7],[1359698400000,151.24],[1359957600000,149.53],[1360044000000,151.05],[1360130400000,151.16],[1360216800000,150.96],[1360303200000,151.8],[1360562400000,151.77],[1360648800000,152.02],[1360735200000,152.15],[1360821600000,152.29],[1360908000000,152.11],[1361253600000,153.25],[1361340000000,151.34],[1361426400000,150.42],[1361512800000,151.89],[1361772000000,149],[1361858400000,150.02],[1361944800000,151.91],[1362031200000,151.61],[1362117600000,152.11],[1362376800000,152.92],[1362463200000,154.29],[1362549600000,154.5],[1362636000000,154.78],[1362722400000,155.44],[1362978000000,156.03],[1363064400000,155.68],[1363150800000,155.91],[1363237200000,156.73],[1363323600000,155.83],[1363582800000,154.97],[1363669200000,154.61],[1363755600000,155.69],[1363842000000,154.36],[1363928400000,155.6],[1364187600000,154.95],[1364274000000,156.19],[1364360400000,156.19],[1364446800000,156.67],[1364533200000,156.67],[1364792400000,156.05],[1364878800000,156.82],[1364965200000,155.23],[1365051600000,155.86],[1365138000000,155.16],[1365397200000,156.21],[1365483600000,156.75],[1365570000000,158.67],[1365742800000,158.8],[1366002000000,155.12],[1366088400000,157.41],[1366174800000,155.11],[1366261200000,154.14],[1366347600000,155.48],[1366606800000,156.17],[1366693200000,157.78],[1366779600000,157.88],[1366866000000,158.52],[1366952400000,158.24! ],[1367211600000,159.3],[1367298000000,159.68],[1367384400000,158.28],[1367470800000,159.75],[1367557200000,161.37],[1367816400000,161.78],[1367902800000,162.6],[1367989200000,163.34],[1368075600000,162.88],[1368162000000,163.41],[1368421200000,163.54],[1368507600000,165.23],[13

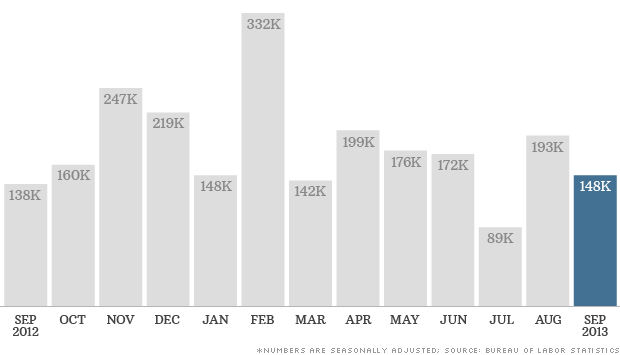

NEW YORK (CNNMoney) The unemployment rate fell to its lowest level since November 2008, but the government's latest jobs report still shows a muddled picture of the economy.

NEW YORK (CNNMoney) The unemployment rate fell to its lowest level since November 2008, but the government's latest jobs report still shows a muddled picture of the economy.  Pre-shutdown jobs report: More of the same

Pre-shutdown jobs report: More of the same ![]()

[ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ]

[ Enlarge Image ]

[ Enlarge Image ]  [ Enlarge Image ]

[ Enlarge Image ]  [ Enlarge Image ]

[ Enlarge Image ]  [ Enlarge Image ]

[ Enlarge Image ]  [ Enlarge Image ]

[ Enlarge Image ]  [ Enlarge Image ]

[ Enlarge Image ]  [ Enlarge Image ]

[ Enlarge Image ]  [ Enlarge Image ]

[ Enlarge Image ]  [ Enlarge Image ]

[ Enlarge Image ]

179.22 (1y: +23%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'SPY', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1355810400000,145.37],[1355896800000,144.29],[1355983200000,145.12],[1356069600000,142.79],[1356328800000,142.35],[1356501600000,141.75],[1356588000000,141.56],[1356674400000,140.03],[1356933600000,142.41],[1357106400000,146.06],[1357192800000,145.73],[1357279200000,146.37],[1357538400000,145.97],[1357624800000,145.55],[1357711200000,145.92],[1357797600000,147.08],[1357884000000,147.07],[1358143200000,146.97],[1358229600000,147.07],[1358316000000,147.05],[1358402400000,148],[1358488800000,148.33],[1358834400000,149.13],[1358920800000,149.37],[1359007200000,149.41],[1359093600000,150.25],[1359352800000,150.07],[1359439200000,150.66],[1359525600000,150.07],[1359612000000,149.7],[1359698400000,151.24],[1359957600000,149.53],[1360044000000,151.05],[1360130400000,151.16],[1360216800000,150.96],[1360303200000,151.8],[1360562400000,151.77],[1360648800000,152.02],[1360735200000,152.15],[1360821600000,152.29],[1360908000000,152.11],[1361253600000,153.25],[1361340000000,151.34],[1361426400000,150.42],[1361512800000,151.89],[1361772000000,149],[1361858400000,150.02],[1361944800000,151.91],[1362031200000,151.61],[1362117600000,152.11],[1362376800000,152.92],[1362463200000,154.29],[1362549600000,154.5],[1362636000000,154.78],[1362722400000,155.44],[1362978000000,156.03],[1363064400000,155.68],[1363150800000,155.91],[1363237200000,156.73],[1363323600000,155.83],[1363582800000,154.97],[1363669200000,154.61],[1363755600000,155.69],[1363842000000,154.36],[1363928400000,155.6],[1364187600000,154.95],[1364274000000,156.19],[1364360400000,156.19],[1364446800000,156.67],[1364533200000,156.67],[1364792400000,156.05],[1364878800000,156.82],[1364965200000,155.23],[1365051600000,155.86],[1365138000000,155.16],[1365397200000,156.21],[1365483600000,156.75],[1365570000000,158.67],[1365742800000,158.8],[1366002000000,155.12],[1366088400000,157.41],[1366174800000,155.11],[1366261200000,154.14],[1366347600000,155.48],[1366606800000,156.17],[1366693200000,157.78],[1366779600000,157.88],[1366866000000,158.52],[1366952400000,158.24! ],[1367211600000,159.3],[1367298000000,159.68],[1367384400000,158.28],[1367470800000,159.75],[1367557200000,161.37],[1367816400000,161.78],[1367902800000,162.6],[1367989200000,163.34],[1368075600000,162.88],[1368162000000,163.41],[1368421200000,163.54],[1368507600000,165.23],[13

179.22 (1y: +23%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'SPY', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1355810400000,145.37],[1355896800000,144.29],[1355983200000,145.12],[1356069600000,142.79],[1356328800000,142.35],[1356501600000,141.75],[1356588000000,141.56],[1356674400000,140.03],[1356933600000,142.41],[1357106400000,146.06],[1357192800000,145.73],[1357279200000,146.37],[1357538400000,145.97],[1357624800000,145.55],[1357711200000,145.92],[1357797600000,147.08],[1357884000000,147.07],[1358143200000,146.97],[1358229600000,147.07],[1358316000000,147.05],[1358402400000,148],[1358488800000,148.33],[1358834400000,149.13],[1358920800000,149.37],[1359007200000,149.41],[1359093600000,150.25],[1359352800000,150.07],[1359439200000,150.66],[1359525600000,150.07],[1359612000000,149.7],[1359698400000,151.24],[1359957600000,149.53],[1360044000000,151.05],[1360130400000,151.16],[1360216800000,150.96],[1360303200000,151.8],[1360562400000,151.77],[1360648800000,152.02],[1360735200000,152.15],[1360821600000,152.29],[1360908000000,152.11],[1361253600000,153.25],[1361340000000,151.34],[1361426400000,150.42],[1361512800000,151.89],[1361772000000,149],[1361858400000,150.02],[1361944800000,151.91],[1362031200000,151.61],[1362117600000,152.11],[1362376800000,152.92],[1362463200000,154.29],[1362549600000,154.5],[1362636000000,154.78],[1362722400000,155.44],[1362978000000,156.03],[1363064400000,155.68],[1363150800000,155.91],[1363237200000,156.73],[1363323600000,155.83],[1363582800000,154.97],[1363669200000,154.61],[1363755600000,155.69],[1363842000000,154.36],[1363928400000,155.6],[1364187600000,154.95],[1364274000000,156.19],[1364360400000,156.19],[1364446800000,156.67],[1364533200000,156.67],[1364792400000,156.05],[1364878800000,156.82],[1364965200000,155.23],[1365051600000,155.86],[1365138000000,155.16],[1365397200000,156.21],[1365483600000,156.75],[1365570000000,158.67],[1365742800000,158.8],[1366002000000,155.12],[1366088400000,157.41],[1366174800000,155.11],[1366261200000,154.14],[1366347600000,155.48],[1366606800000,156.17],[1366693200000,157.78],[1366779600000,157.88],[1366866000000,158.52],[1366952400000,158.24! ],[1367211600000,159.3],[1367298000000,159.68],[1367384400000,158.28],[1367470800000,159.75],[1367557200000,161.37],[1367816400000,161.78],[1367902800000,162.6],[1367989200000,163.34],[1368075600000,162.88],[1368162000000,163.41],[1368421200000,163.54],[1368507600000,165.23],[13